Introduction to Investment

ACCREDITED BY CPD & IAP | Free Digital Certificate Included | Unlimited Access 365 Days | Quality e-Learning Materials

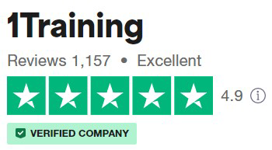

1 Training

Summary

- Exam(s) / assessment(s) is included in price

- TOTUM card available but not included in price What's this?

Overview

Certificate in Introduction to Investment - Level 3

If you want to get a better understanding of investments of the financial system, the Certificate in Introduction to Investment Level 3 (USA Standards) is designed to teach you about the categories of investment, understanding non-financial investments and investment instruments. Aspiring or already employed investment bankers and insurance analysts will find this course substantial in its material and focus. The course will introduce you to the financial notions of risk and return. You will learn what it takes to work in such a role and understand the responsibilities of evaluating investment portfolios.

The course is extensive and will discuss key modules in-depth such as four phases of the life-cycle, the financial system, investment instruments and investment principles. Each topic will be explored fully to ensure learners gain a complete understanding of the subject matter.

The Certificate in Introduction to Investment Level 3 will get you acquainted with the financial system in detail. The course will provide you with an opportunity to empower yourself with a wealth of knowledge of distinguishing the ultimate investments of the financial system, the objectives of investment and the principle underlying the valuation of investment. This course is a stepping stone to taking your career in investment to the next level. You will see the door open to exciting opportunities and future career prospects.

Please Note: This Course is Based on USA Standards.

Why you should consider 1Training?

As improvements and advancements are made in technology, online courses are no longer just conventional means of studying at affordable costs. In many aspects online training offers superiority to traditional learning. There is an effectiveness and convenience that traditional learning cannot provide. The overall convenience and flexibility makes it a superior learning method.

1Training offers the most convenient path to gain an internationally recognised qualification that will give you the opportunity to put into practice your skill and expertise in an enterprise or corporate environment. You can study at your own pace at 1Training and you will be provided with all the necessary material, tutorials, qualified course instructor and multiple free resources which include Free CV writing pack, Nus Discounted Card, Free career support and course demo to make your learning experience enriching and more rewarding.

CPD

Course media

Description

What will I learn?

- Become familiar with the general structure of primary and secondary equity markets

- Learn to explore qualitative concepts such as valuation and market efficiency

- Describe the phases of the individual’s life-cycle

- Understand the rules that pertain to each phase of the life-cycle

- Learn of the rules which are applied during and throughout the life-cycle

COURSE CURRICULUM

Module 01 : Four Phases of the Life-Cycle

Module 02 : The Financial System

Module 03 : Investment Instruments

Module 04 : Investment Principles

Module 05 : Endnotes

Access Duration

The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time.

Method of assessment

In order to complete the Certificate in Introduction to Investment – Level 3, learners will have to take a mock exam and final exam.

- No. of Questions: 30

- Exam Duration: 40 minutes

- Exam format: multiple questions

Certification

Upon the successful completion of the course, you will be awarded the “Certificate inIntroduction to Investment – Level 3”.

KEY FEATURES

- Gain an accredited UK qualification

- Access to excellent quality study materials

- Learners will be eligible for TOTUM Discount Card

- Personalized learning experience

- One year’s access to the course

- Support by phone, live chat, and email

Who is this course for?

- This course is ideally suited for investment bankers, financial planners, mortgage advisors, insurance analysts and trust fund managers

- This course is also helpful to accountants who want to update their knowledge

Requirements

- All learners should be over the age of 16 and have a basic understanding of Maths, English and ICT.

- A sound educational background is an advantage.

Career path

Once qualified in the Certificate in Introduction to Investment – Level 3 , you will gain an accredited qualification that will prove worthwhile in working for a range of job positions in the accounting or finance industry. Given below are job roles you can land with this certification.

- Investment Bankers

- Insurance Analysts

- Mortgage Advisors

- Financial Planners

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.